Predictions for Digital Health and the Transformation of a Broken System

by Tom Humphrey and Luis Villarreal

Image Credit: Cartoon Wangsrimongkol on Shotzr images

Image Credit: Cartoon Wangsrimongkol on Shotzr images

The State of Play in Healthcare

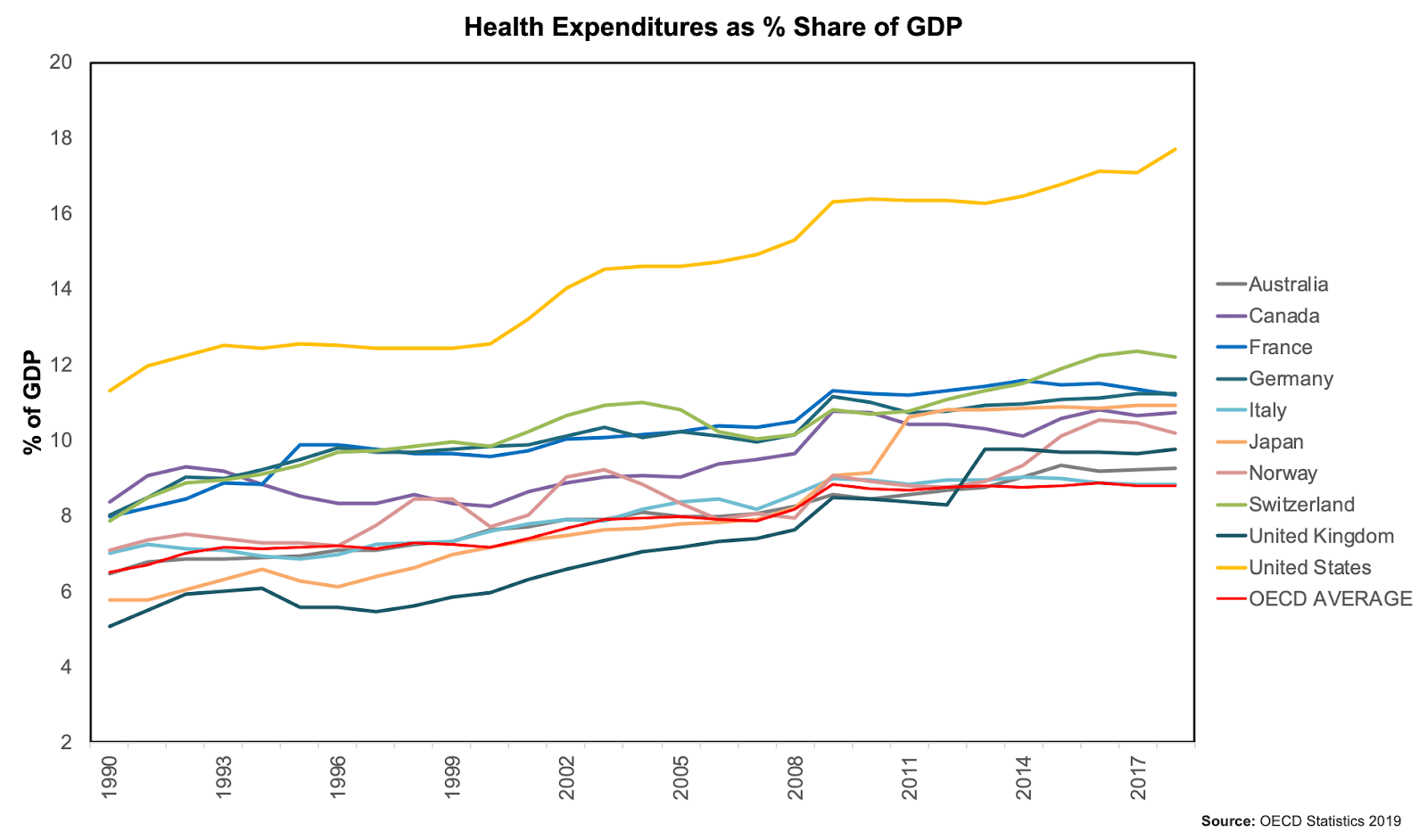

The U.S. healthcare system is on life support and the novel coronavirus is not to blame. In 2018, the U.S. spent on average $11,172 per person or $3.6 trillion on healthcare – a staggering 17.7% share of GDP and more than twice the average OECD country.

Source: OECD Org 2020

Source: OECD Org 2020

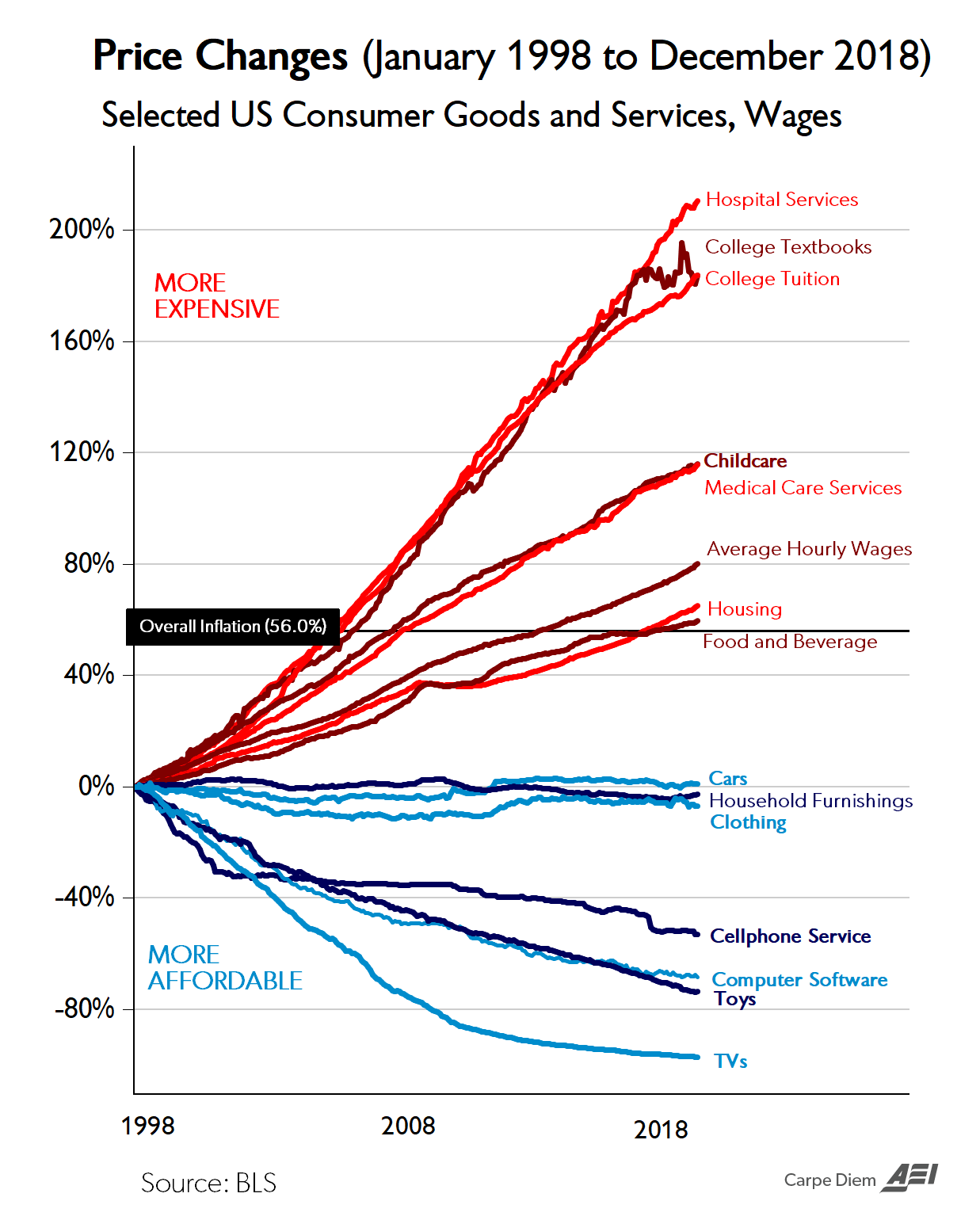

America is investing into healthcare more than double what other developed countries are on a per capita basis, yet it sits at 46th in the world for average life expectancy (right behind Cuba and Estonia) and has experienced an incredibly lacklustre performance through COVID-19 (currently still crowns #1 in the world for both cases and deaths and saw significant shortcomings on hospital beds, ventilators, protective gear, and more). The chart below tells a compelling story – from 1998 to 2018, whilst general inflation rose 56% overall and many goods and services have seen declining prices and efficiencies, the price of hospital services have risen over 200% and other medical services 120%. Mix in an aging population, 40 million freshly unemployed Americans, a shortage of clinicians, and rapidly rising pharmaceutical prices and the outlook is pretty bleak.

Source: AEV based on BLS data

Source: AEV based on BLS data

How did this happen? There are many things we could point at, but one overarching theme upon which blame is often cast is the fee for service model.

The US healthcare system was designed to be provider-centric – i.e. physicians and healthcare professionals get reimbursed for procedures (or health services) performed rather than value (or health outcomes) delivered. Fee-for-service programs traditionally revolve around the practice of high-cost reactive medicine and have been a big driver of excessive services, uneven care delivery and health inflation – neither patients nor providers are financially accountable.

US regulatory agencies have acknowledged the inadequacy of the situation and have been supporting a transition to value-based care – a model that is patient-centered and emphasizes and incentivizes better health outcomes at a reduced cost, not more services at a higher cost. Unfortunately, progress toward this has been incredibly slow and health institutions are now in a predicament. Most health institutions are being severely affected by the fee for service model during this pandemic – they are facing budget crises as this model is structured to reward high cost procedures that are not being performed at this time. All these organizations are cancelling elective procedures as well as their in person routine doctor visits. Some of them have even been forced to cut pay and lay off workers, while others wonder if they will bounce back from this at all. At a time when we need all available capacity at our disposal, this situation is troublesome.

Key Predictions for 2025

So, how do we fix a healthcare system that is so broken? The answer, to a large degree, is digital health.

Digital health will be a critical driver in the shift to value-based care and drive progress toward, according to the American Medical Association, the 4 objectives of the system – improved patient experience, better health outcomes, reduced costs and increase in provider’s satisfaction. The first wave of digital health tech (software based, not medicals or devices) has focused predominantly around companies that took mainly analog processes on paper and slides and switched them to a more accessible digital format – the core EHRs leading the charge. The coming wave of digital health will be more focused on the delivery of preventive care, the fluid sharing of patients’ records and data, great accessibility, patient tracking and early intervention, etc.

With that in mind, here are some of our core predictions for digital health for the next 3-5 years:

- Temporary changes to virtual health regulation driven by COVID-19 will likely stick and ignite growth – The CMS under a public health emergency order issued by the President’s administration announced maximum flexibility in regulation to respond to COVID-19, including an increase in telehealth that allows providers to take care of patients while mitigating the risk of spreading the virus. CMS has been slowly supporting and beginning to open up reimbursement codes for virtual health and remote patient monitoring over the past few years in an effort to shift to lower cost, more convenient, value-based care. Given the benefits to stakeholders and the greater exposure to these digital health practices that COVID-19 has spurred, it’s highly likely that most of these changes will stick. This will in turn ignite a boom in the digital health segment and accelerate the scaling of businesses.

- Virtual health services will see substantial growth – The pandemic accelerated the demand for telehealth services by forcing adoption and putting its benefits on full display. A survey from McKinsey & Co. suggests that adoption is gaining momentum – 46% of consumers are now using telehealth services versus 11% in 2019, and 76% of the participants surveyed said that they would be interested in using them in the future.

- Mobile health will revamp healthcare – “An apple (and android) a day keeps the doctor away” has never been more relevant! In a time of an aging population where 6 out of 10 Americans suffer a chronic condition, preventive care will drive the future of healthcare. Remote patient monitoring (RPM) devices will power the transformation because they can track a patient’s health condition outside the doctor’s office and allow early intervention for potential problems.

- EHRs will step up to support more intelligence-based care – EHRs currently have a major flaw – there’s no universal standard, meaning that even if all records are digitized, they can’t be shared among providers because systems are usually not compatible. Going forward, we will see a more collaborative healthcare environment that supports data sharing/interoperability and allows for comprehensive, intelligence-based Electronic Health Records. Providers need to consider EHRs as the key to succeed in transforming healthcare into value-based care for the benefit of patients. EHRs provide a rich dataset that can be used in predictive analytics to develop population wellness programs and better support the efforts of remote patient monitoring and care management programs.

- Artificial Intelligence will boost productivity and extend the efficiency of care delivery – In 2017, the US spent $812 billion or $2,500 per person on healthcare administrative costs, a huge burden to the healthcare system. Combined with a growing shortage of clinicians and nurses, this will raise the role of AI in driving efficiencies, reinventing clinical workflows, improving the quality and delivery of care, and extending the number of patients any one caregiver can see. Not only that, but AI/ML have the massive potential to revolutionize healthcare with frontier of science applications. For instance, Tempus has built the world’s largest library of clinical data and is utilizing data-driven precision medicine (via AI/ML) to accelerate cancer research. Another example would be Kaia Health and Exer AI, two companies that use computer vision and AI to make therapy, physical rehab and exercise cheaper and more accessible. Their software analyzes motions and movements from thousands of athletes and their product provides real-time feedback to perfect your movements.

- The stigma on behavioral health will evaporate – The stigma associated with behavioral health has reduced significantly over the past decade. Today, having the Calm, Headspace, or Cactus apps on your homescreen is almost a badge of pride – an acknowledgement of one’s investment in self-reflection. COVID-19 has both rapidly extended the incidence of behavioral health issues (rising unemployment, concern over the future of our world, cabin fever through stay at home, rising alcoholism, etc) as well as the adoption and growth of virtual services that support it. Behavioral health is a key component in the transition to preventive care as conditions such as depression, isolation, or anxiety can often turn into chronic disease or lead to greater stress on the system. More employers are offering digital mental health services to their employees today than ever before — NetApp, a cloud-data service company based in Boulder CO, has called it a game-changer for the well-being of its employees.

- Healthcare will become more consumer-driven – Consumers want to take control of their health and wellness and they want to choose the care delivery channel that best fits their lifestyle. For this reason, we are observing a rise in multiple niche sectors, such as concierge health and direct-to consumer (D2C) services and platforms that streamline the process of shopping for medical services and deliver an end-to-end experience. On the one hand, Microsoft is honing in on the D2C space – they recently launched a consumer healthcare platform in collaboration with Adobe and Change Healthcare. The platform ‘Connected Consumer Healthcare’ delivers an enhanced patient experience that includes – access to physician details, patient reviews and price comparisons, as well as the ability to schedule appointments, check-in online and pay for services, among others. Conversely, OneMedical, a direct care provider, is focusing their strategy on a different niche – concierge services. These services are considered an add-on to commercial insurance. Their selling point is convenience – by paying an annual membership fee of $199, members gain access to services such as the ability to schedule same-day appointments and text your doctor.

- Health carriers will increase investments in digital health and direct care solutions – There has been a cultural shift in the industry and healthcare carriers are playing a more active role in care delivery as they seek to bolster their member offerings with solutions that improve patient outcomes at lower cost. Carriers are now increasingly collaborating with providers, investors and digital health firms to reorientate around preventative, not reactive, care. For instance, UnitedHealth acquired Vivify Health, a remote patient monitoring start-up, this past October 2019, providing them with early intervention capabilities. UnitedHealth is also offering a virtual health service for members where they can talk to a doctor 24/7 by phone or video. And, the success of Livongo has provided a roadmap for app-based, carrier-distributed care models and many others are following.

- The tech giants will significantly extend their reach into healthcare – The “Big Four” (a.k.a. Amazon, Apple, Google and Microsoft) have been signaling high interest in healthcare. This makes sense – when you are that size and looking to satiate shareholder expectations for continued growth, few opportunities left are big enough to move the needle (fintech is another you see getting a lot of attention). Also, they are fairly well-positioned given they own the key rails to consumers. They will be strategic in how they approach the space and play to their capabilities – for example, Amazon is leveraging their e-commerce and logistics services to extend into prescription drug delivery. Apple is honing in on clinical research through data collection from its wearables, and the Apple watch will likely start incorporating more functionalities such as glucose and blood pressure monitoring, sleep tracking and food logging. Google, on the other hand, is utilizing their AI/ML technology ‘DeepVariant’ to drive genomic sequencing and precision medicine (similar to Tempus Health). And finally, Microsoft is offering their cloud service platform Azure to health systems as a pathway to collect and utilize data from multiple sources, while maintaining patient privacy and confidentiality (as discussed above with their new platform service Connected Consumer Healthcare).

____________

The pandemic has not only unveiled the shortcomings of healthcare in America, but magnified them. The opportunity to fundamentally improve our care delivery model is now no longer important, but critical.